Private Equity Info Blog

Insights Blog

Featured Article

- Divya Ravikumar

- October 22, 2024

A deep dive on AI and Machine Learning private equity investments

Explore the rise of investments in AI and Machine Learning, including key industries and recent notable transactions.

Recent Articles

We’re excited to share a preview of AI Search, a new tool that brings natural language search to Private Equity Info’s...

Private equity firms rely heavily on strong advisor relationships with investment banks and M&A law firms to uncover...

Every six months, we take a look at the ratio of private equity investments to exits to evaluate how the market is...

We recently highlighted that thousands of PE-backed companies appear ripe for exit, supported by a key metric: the...

Cross-border private equity deal flow between the United States and Europe has generally trended up for the past two...

Private equity firms are sharpening their sector strategies amid a complex dealmaking environment shaped by macro...

In today’s deal environment, where platform investments have slowed, many private equity firms are doubling down on...

Manufacturing isn’t typically the first word that comes to mind when thinking of high-growth, headline-making private...

Private Equity portfolio company holding periods serve as a leading indicator for future deal flow, especially when...

For private equity firms looking to tap into the full range of deal opportunities and discover new deal sources,...

Private equity firms depend on quality deal flow in their target industries, and investment banks play a crucial role...

The U.S. continues to be a prime destination for cross-border private equity investments, with firms from around the...

In our previous analysis of investment versus exit ratios, we examined how macroeconomic conditions, government...

Looking to get more out of your searches on Private Equity Info?

Private equity firms are likely to employ an add-on acquisition strategy to compliment a platform acquisition's organic...

Private equity firms concentrate investments in high-growth states, aligning with local economic strengths and...

Using data from our M&A research database, we analyzed private equity holding periods from 2000 through 2025 to assess...

I’ve been asked the following question on several occasions:

Using data from our M&A database, we identified the leading Private Equity firms by number of deals closed in 2024,...

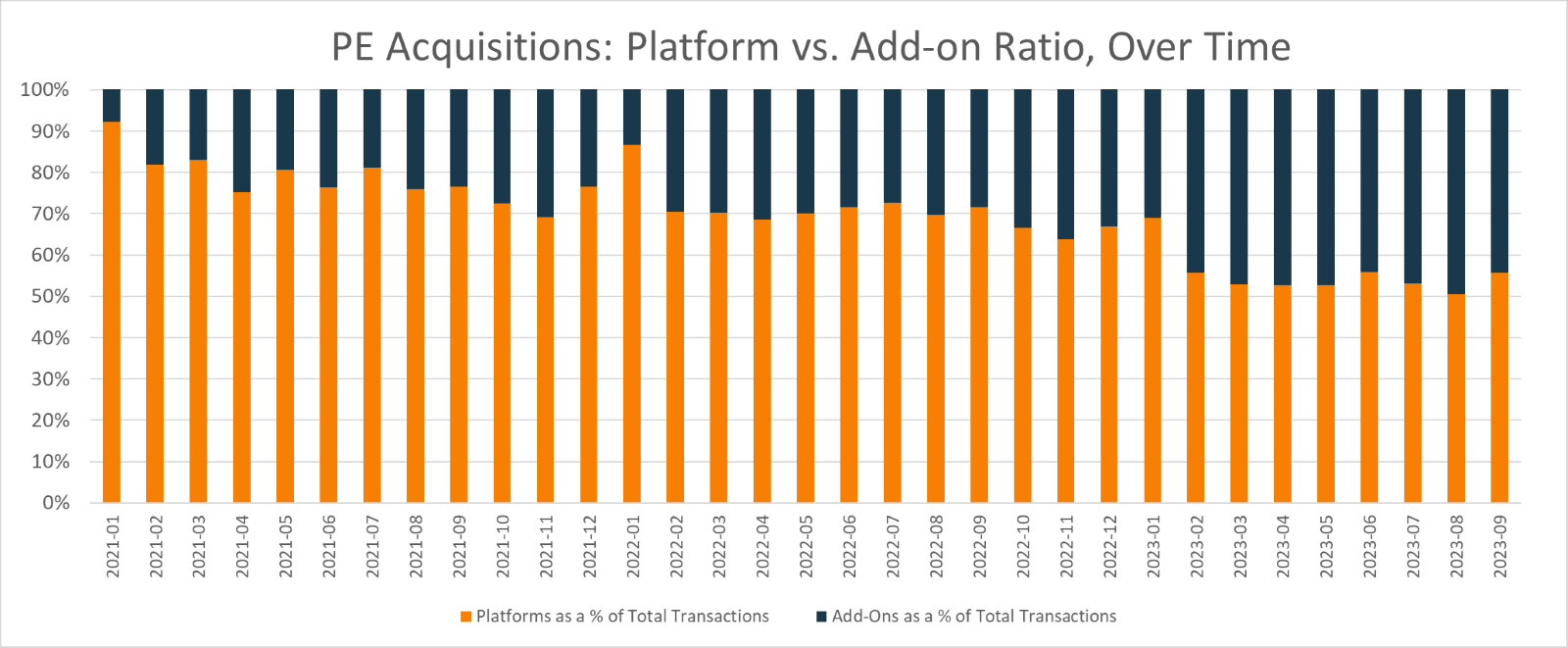

Private equity firms continue to leverage add-on acquisitions as a strategic tool to accelerate growth, achieve...

To close out 2024, we probed our database to determine the top industries of interest for the 1,411 platform...

Private equity activity in 2024 reflected a strategic pivot driven by evolving macroeconomics and market dynamics. The...

From steady growth to pandemic-driven surges, private equity acquisitions have shifted from a platform-dominated market...

We recently analyzed private equity firms portfolio company data to determine which firms are holding the most...

Private equity firms differ substantially in size as measured by factors like fund size, assets under management, or...

Private equity investments in the beauty care industry surged during COVID's e-commerce boom but have more recently...

Artificial Intelligence and Machine Learning are revolutionizing industries by reshaping business practices and fueling...

Traveling to conferences or client site visits can be daunting and perhaps a little stressful if you aren’t equipped...

Governmental policies and actions of the Federal Reserve have been the primary drivers of M&A trends over the past two...

Private equity firms are increasingly focused on add-on acquisitions, as we previously reported.

We reported in July that private equity firms are delaying exits and holding portfolio companies longer to ensure they...

Acquisitions by private equity firms are trending to a higher mix of add-on investments, relative to platform...

Private equity firms are investing in smaller deals and exercising caution with larger deals, according to new data...

Using our M&A research database, we updated our tracking of private equity Holding Periods to include data from 2000...

This article was first published in the Spring issue of Middle Market Dealmaker, the official print publication of the...

Private Equity Info founder and managing partner Andy Jones recently joined Cornerstone International Alliance managing...

Integrity between principles can be considerably more valuable than specific deal points in an M&A transaction.

On occasion, corporate CEOs ask if we can help find the best investment bank to represent them in either a capital...

People often speak of M&A transaction valuations in multiples of EBITDA because EBITDA is a proxy for cash flow, and...

Leaders recognize the potential of Artificial Intelligence, and reports have been unanimous about the opportunity: AI...

Across industries, Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally transforming business...

While the discounted cash flow (DCF) methodology is the most rigorous and financially sound for business valuation, it...

Access to quality deal flow is the single largest determinant of success in M&A.

Private Equity Info is a valuable resource for private equity firms seeking to enhance deal sourcing, monitor...

For years, the private equity industry has been moving down market, as firms invest in smaller deals in the middle...

The best indicator of a private equity firm’s interest in a specific industry is that they've already made a similar...

In more uncertain economic climates, the private equity industry collectively shifts to smaller deals.

One of the challenges of managing a mid-market M&A firm is coping with the sporadic, binary nature of the payoff for...

The Private Equity Info team hosts demos every day toshowcase the power of our M&A research database.

The median holding period for private equity-backed portfolio companies is now 5.6years, the highest value since...

Once a nascent industry, digital media companies have become attractive targets for top private equity firms. In 2022,...

The number of private equity platform acquisitions and add-on acquisitions dropped significantly in 2023, showing the...

Private equity firms collectively acquire thousands of companies every year. PE firms often acquire platform companies...

Customer Satisfaction Survey 2023: Results Show We Exceed Client Expectations in Quality of Data, Customer Service, and...

When I launched Private Equity Info in 2005, I sought to provide the Investment banking industry with a solution to...

.png)

.png)

.png)

.png)

.png)

.png)

.png)