For years, the private equity industry has been moving down market, as firms invest in smaller deals in the middle market and lower middle market. However, our most recent review of the data suggests that trend is reversing.

As an industry, private equity firms' acquisition criteria for platform investments is now shifting to slightly larger deals. That is, the percentage of all firms looking into the lower middle market is lower now than it was when we last reviewed this data four years ago.

This does not mean there are fewer private equity firms looking for smaller deals, because the private equity industry continues to expand. But it does mean the mix is shifting, a bit upmarket.

This shift is nuanced. On average, private equity firms have shifted down in the minimum revenue metric they will consider for platform acquisitions, but have shifted up market on the other metrics (min EBITDA, min Enterprise Value, and min Equity). This suggests there’s now a greater desire and premium placed on cash flow (and hence increased valuation) over revenue.

Said another way, in the last few years, PE firms have shifted to prefer slightly lower revenue but higher margin businesses as acquisition targets. This correlates to behavior we would expect in a higher interest rate environment as more cash is required for debt service.

Private Equity Info’s M&A research database tracks more than 119,000 portfolio companies and 4,900 private equity firms. We recently evaluated the PE platform acquisition criteria metrics to determine the target company size ranges attract the most interest from private equity firms. Subscribers can filter private equity firms by their acquisition criteria to more quickly find buyers, or to refine their own investment criteria. Learn more about Private Equity Info’s features here.

Acquisition Criteria Metrics & Data

The charts below show the distribution of private equity firms’ acquisition criteria for the minimum revenue, EBIDTA, enterprise value and equity investment. These graphs demonstrate the deal size priorities across the private equity industry, for platform investments.

To be clear, this report is not based on transaction comps, but on the stated, desired ranges for platform acquisitions from private equity investors.

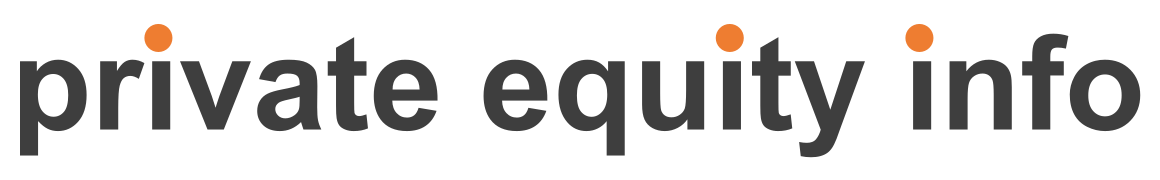

Min Revenue

According to our study, a slightly larger percentage of PE firms will now consider platform acquisitions with less than $10 million range.

2023 Data

- 65% of PE firms will look at deals with revenue of $10 million or less.

- 89% of PE firms will look at deals with revenue of $25 million or less.

Comparing this to 2019...

2019 Data

- 60% of PE firms will look at deals with revenue of $10 million or less.

- 88% of PE firms will look at deals with revenue of $25 million or less.

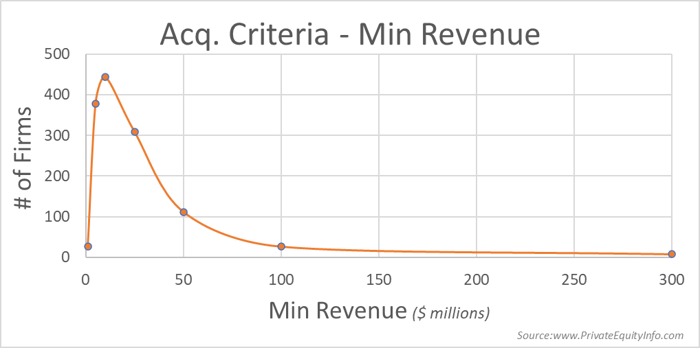

Min EBITDA

The percentage of PE firms interested acquisitions with EBITDA less than $3 million has ticked down.

2023 Data

- 72% of PE firms will look at deals with EBITDA of $3 million or less.

- 91% of PE firms will look at deals with EBITDA of $5 million or less.

2019 Data

- 78% of PE firms will look at deals with EBITDA of $3 million or less.

- 95% of PE firms will look at deals with EBITDA of $5 million or less.

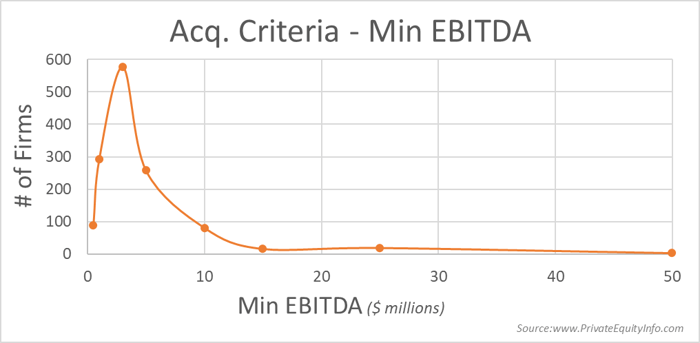

Min Enterprise Value

The percentage of PE firms interested in platform acquisitions with Enterprise Values less than $25 million has declined substantially.

2023 Data

- 33% of PE firms will look at deals with Enterprise Values of $10 million or less.

- 61% of PE firms will look at deals with Enterprise Values of $25 million or less.

2019 Data

- 49% of PE firms will look at deals with Enterprise Values of $10 million or less.

- 80% of PE firms will look at deals with Enterprise Values of $25 million or less.

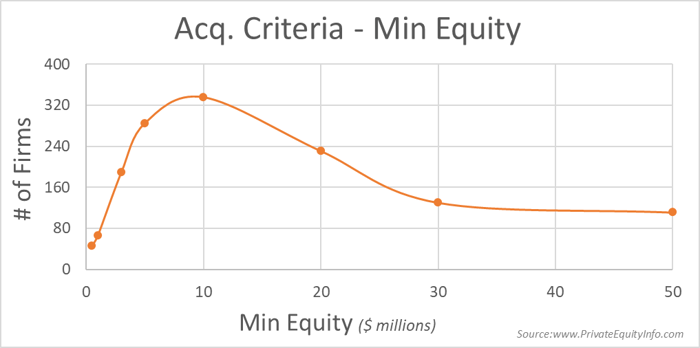

Min Equity Investment

The percentage of PE firms writing an Equity check less than $25 million has declined just a bit in the last four years.

2023 Data

- 63% of PE firms will write an Equity check for $10 million or less.

- 78% of PE firms will write an Equity check for $20 million or less.

2019 Data

- 66% of PE firms will write an Equity check for $10 million or less.

- 81% of PE firms will write an Equity check for $20 million or less.

Capital Structure

We also evaluated the ratio between Equity and Enterprise Value. This calculation represents a proxy for the percentage of equity that private equity firms place in their capital structure upon the initial acquisition of a new platform company. Our acquisition criteria data implies current deal structures are structured with ~50% equity.