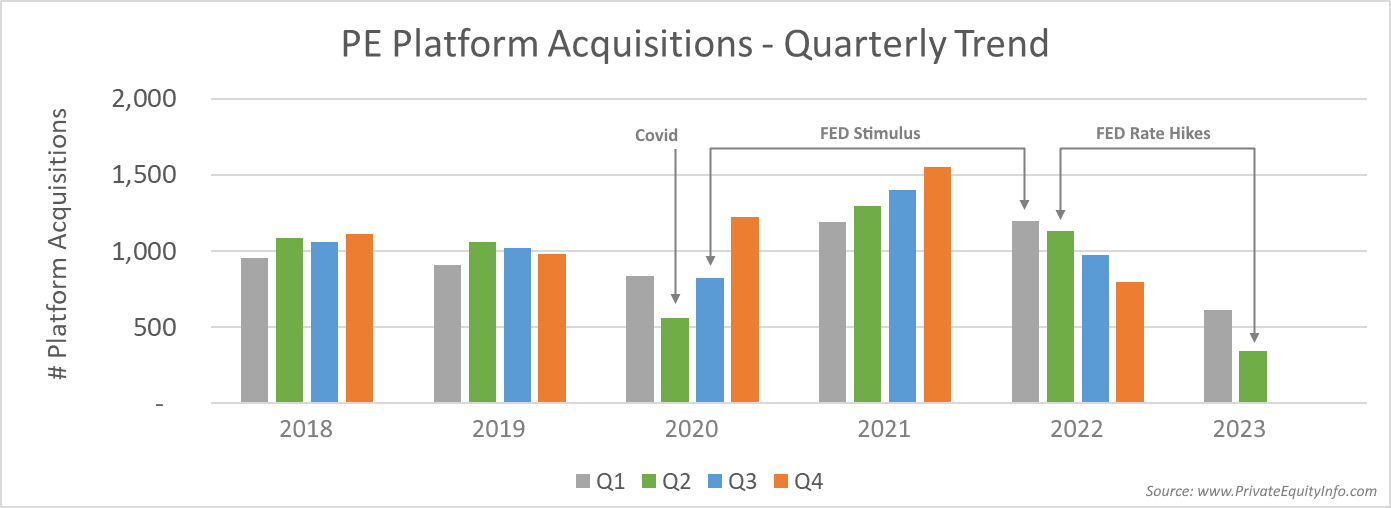

This variability in platform acquisitions not only impacts the velocity of M&A transactions, but also valuations, as supply and demand imbalances occur during deal peaks and troughs. The back half of 2021 and the first half of 2022 were seller’s markets, with inflated valuations driven by excess capital and low interest rates on debt.

Are we now moving to a buyer’s market or did the recent peak in Platform acquisitions only clear a bulge in the deal pipeline?

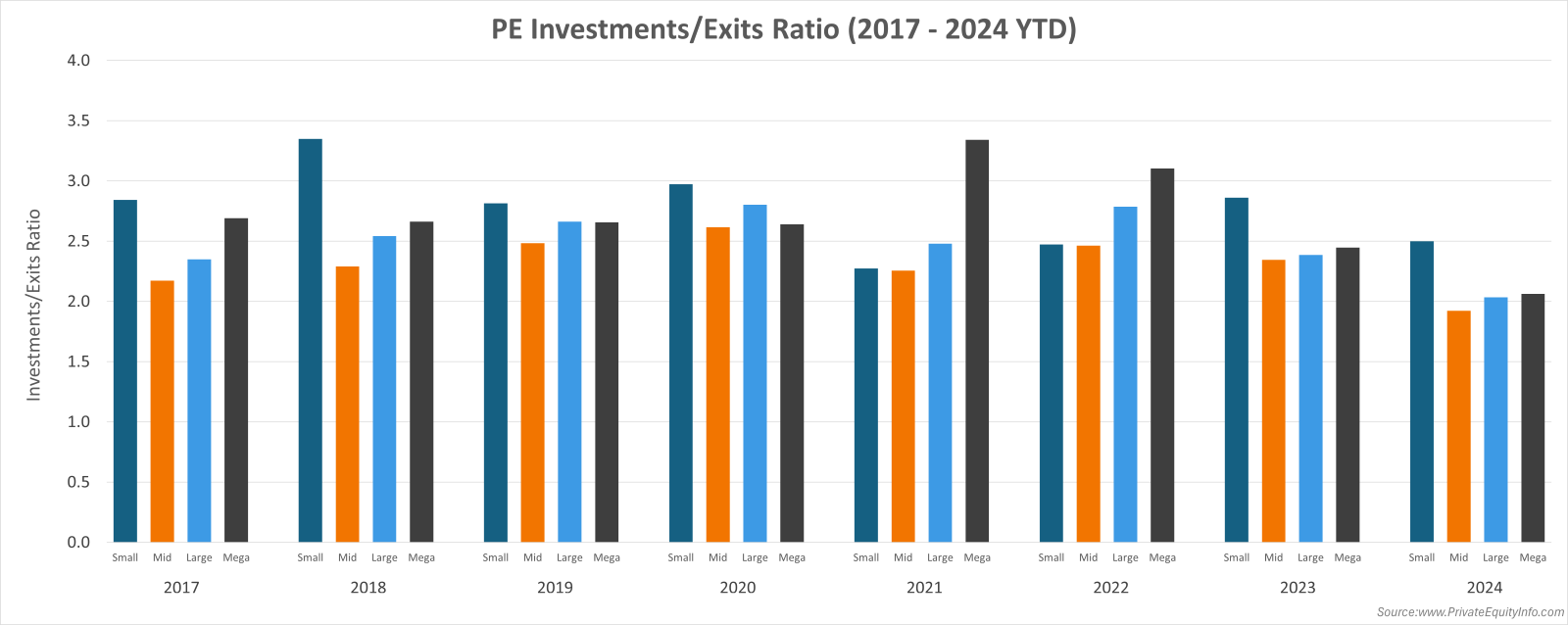

One signal is found in PEI's data on the pace of add-on investments. An increase in the number of add-on acquisitions would signal a focus on lower risk, easier-to-finance investments that would complement the peak of platform acquisitions in 2021 and the first half of 2022.

But private equity is acquiring fewer add-on investments, as well, as depicted in the chart below. This is not an industry shift from platforms to add-on investments, it is a shift in private equity's overall appetite for acquisitions.

If you'd like to explore the data, Private Equity Info is offering a free downloadable list that includes the 300+ platform acquisitions completed in the second quarter, as well as more complete lists of platform and add-on acquisitions that include more detailed fields such as executive contact information, available for purchase in the PEI Shop.