Access to quality deal flow is the single largest determinant of success in M&A.

Common deal sources are well-known. We've written about ways that our research database helps investment banks more easily target ideal private equity investors, and how private equity firms can amplify deal flow from investment banks.

But there's steady flow of potential deal intelligence that remains somewhat untapped: aged private equity-backed portfolio companies that may be seeking an exit.

Potential deal flow

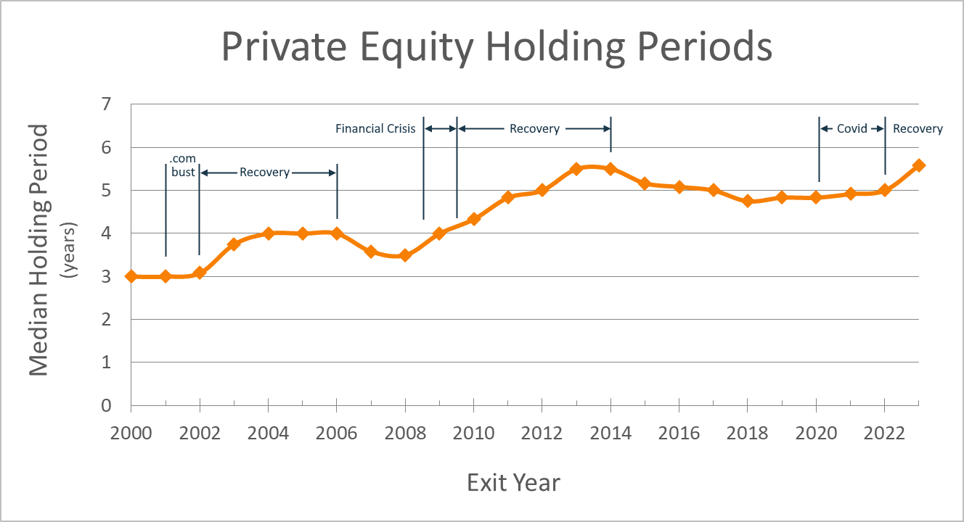

The statistics from our private equity research database show the median holding period for private equity portfolio companies is currently 5.6 years.

By definition of median, half of all portfolio companies exit before they reach the median age under private equity ownership, which means that they could be a source for under-the-radar deal flow.

The chart below shows the changes in holding periods over time. Currently, holding periods are longer than the historical mean, reflecting macroeconomic trends.

Private equity owned portfolio companies crossing the 4-year holding duration in Q1-2024 are strong candidates for a transaction, in that they have a reasonably high probability of a near-term exit. This is a potential source of quality deal flow, M&A intelligence, and transaction ideas, especially if some of these cohort-aged portfolio companies fit together strategically.

The data

The PEI M&A Research Database is currently tracking 742 private equity backed portfolio companies globally that are crossing this 4-year age mark in Q1-2024. Of these, 409 portfolio companies are U.S. based.

The table below shows the industry breakdown of portfolio companies crossing the 4-year mark that are still held as active investments. Portfolio companies in the manufacturing, healthcare and technology industries represent 29% of the companies crossing the 4-year age in Q1-2024.

|

Industry |

# of Investments |

% of Population |

|

Manufacturing |

92 |

12% |

|

Healthcare |

67 |

9% |

|

Technology |

62 |

8% |

|

Software |

30 |

4% |

|

Food and Beverage |

20 |

3% |

|

Biotechnology |

16 |

2% |

|

Cybersecurity |

14 |

2% |

|

Construction |

13 |

2% |

|

E-commerce |

13 |

2% |

|

Education |

12 |

2% |

|

Biopharmaceuticals |

11 |

1% |

|

Retail |

10 |

1% |

|

Entertainment |

10 |

1% |

|

Financial Services |

10 |

1% |

|

Logistics |

9 |

1% |

Get better M&A intelligence

Private Equity Info’s 20-year focus on M&A transactions allows us to provide investment banks and private equity firms with unparalleled access to high-quality, specialty private equity data like holding durations, and research features that allow for advanced filtering built to identify new deal flow opportunities. After refining and saving lists, our up-to-date contact data ensures that you can reach out to the right executives, directly from your CRM.

To gain insights from these potential near-term transactions, schedule a demo to see the power of our database, or preview the quality of our data by ordering the list of aged portfolio companies from our Shop.

Purchase a standalone list

Priced at $295, the Excel file contains 742 private equity backed portfolio companies, with data including:

Portfolio company: name, website, city, state, country, business description

Private equity firm: name, website, address, city, state, zip, country, phone