Contact us

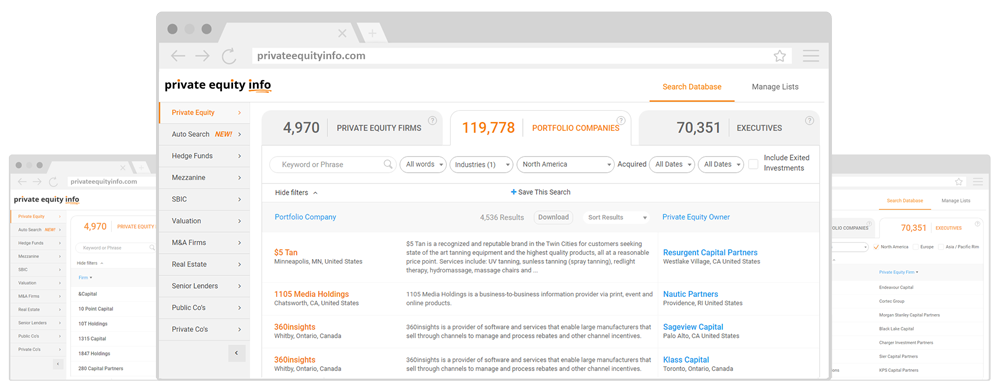

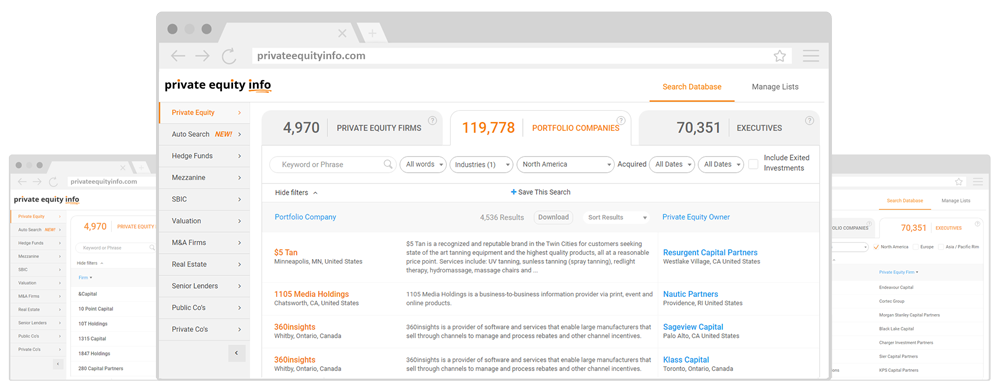

Founded in 2005, Private Equity Info (Privateequityinfo.com) has become the trusted source for M&A Research through its ability to perform rich, targeted searches of private equity firms, their investment interests, portfolio companies, professional bios, and more.